SECURITIES AND EXCHANGE COMMISSION

_____________________

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

_____________________

Filed by the Registrant ☒x Filed by a Party other than the Registrant ☐o Check the appropriate box: | ☐ | | | | |

| o | Preliminary Proxy Statement |

| ☐ |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

| x | Definitive Proxy Statement |

| ☐ |

| o | Definitive Additional Materials |

| ☐ |

| o | Soliciting Material Under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ |

| o | Fee paid previously with preliminary materials. |

1633 Broadway, Suite 22C

New York, New York 10019

566 Queensbury Avenue

Queensbury, NY 12804

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

June 12, 2023MAY 23, 2024

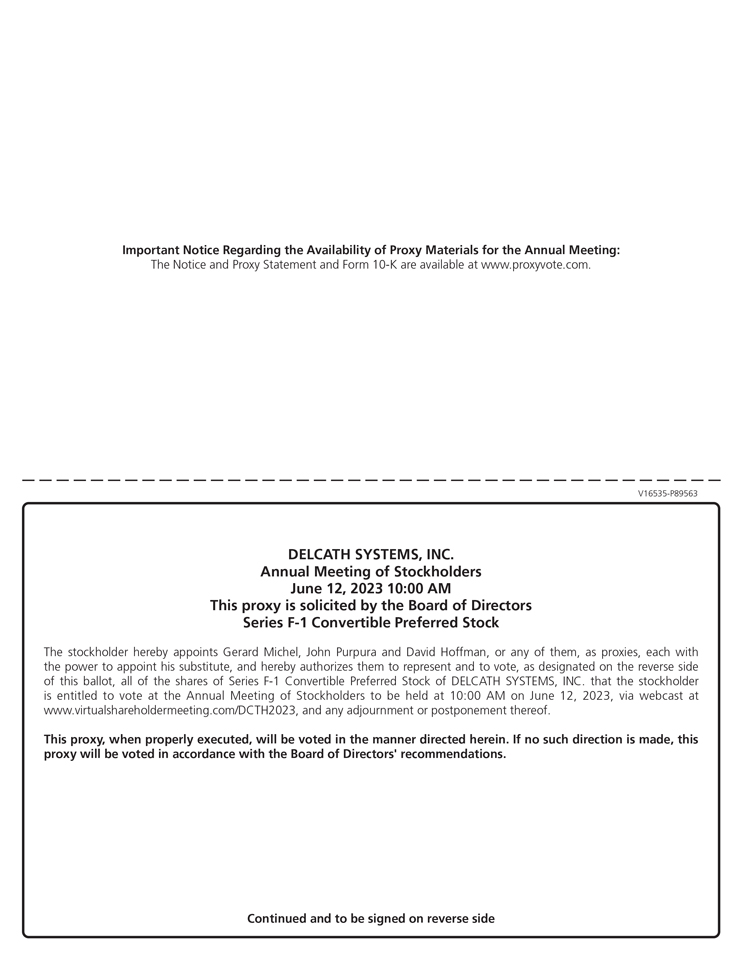

To the Stockholders of Delcath Systems, Inc.:

Notice is hereby given that the

20232024 Annual Meeting of Stockholders of Delcath Systems, Inc., a Delaware corporation (the “Company”), will be held virtually at 10:00 a.m. Eastern Time on

June 12, 2023May 23, 2024 (the “Annual Meeting”). There will not be an option to attend the Annual Meeting at a physical location.

At the Annual Meeting, the stockholders of the Company will be asked to consider and take action on the following proposals:

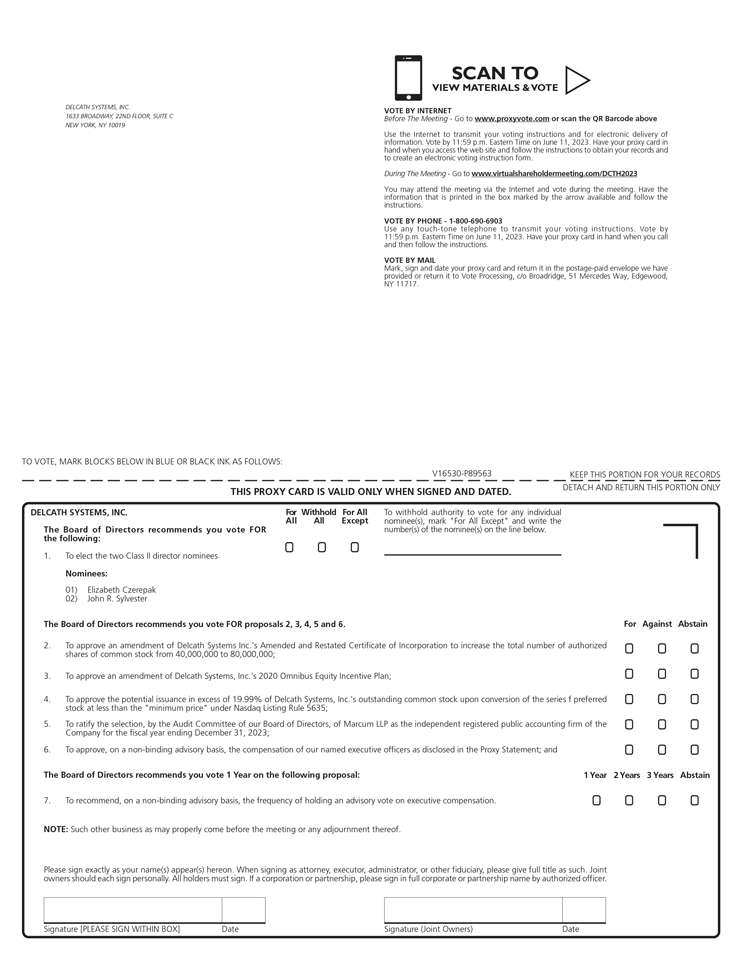

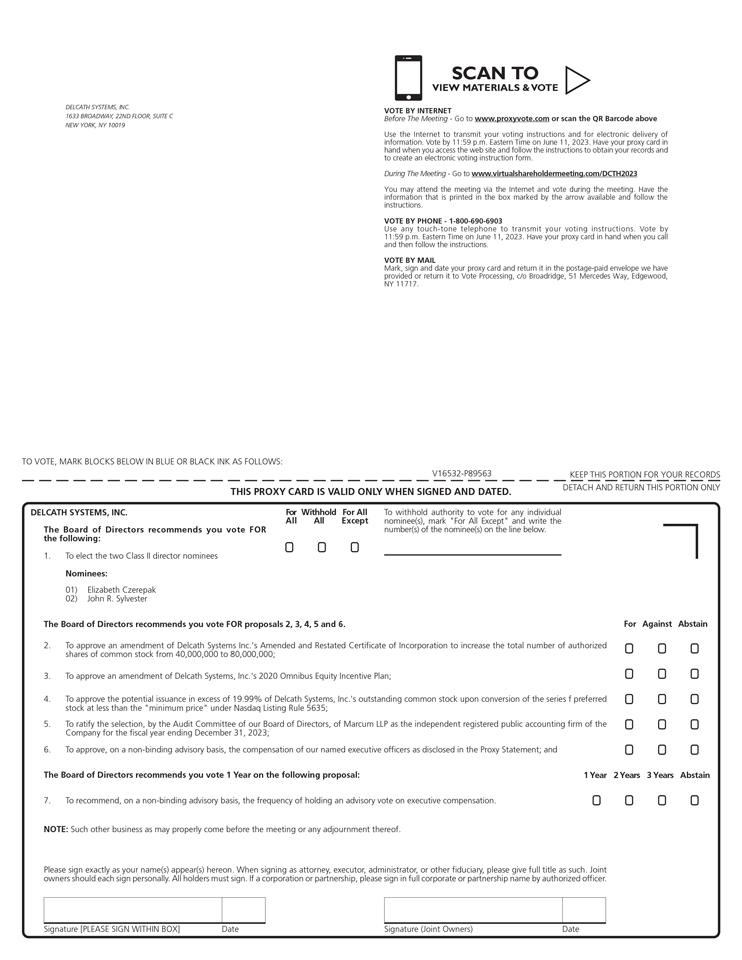

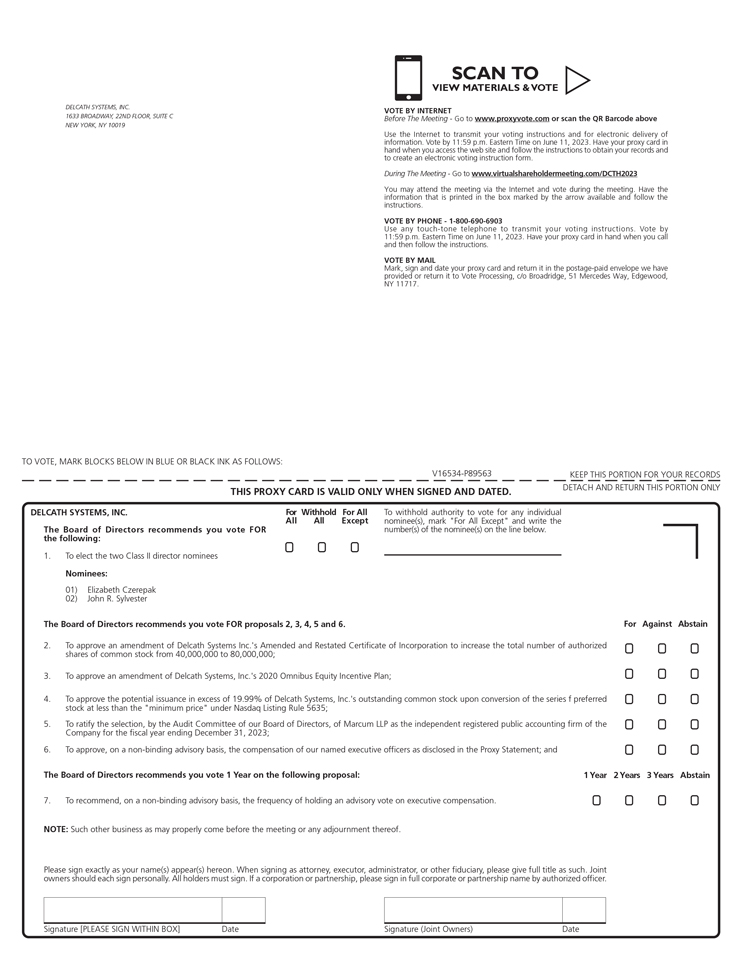

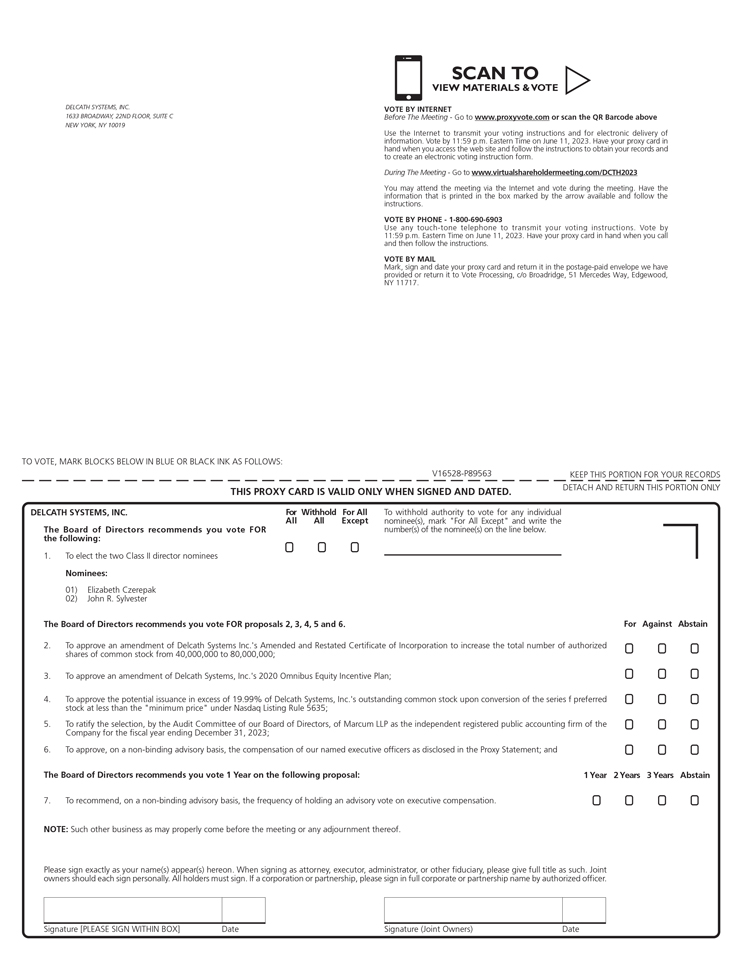

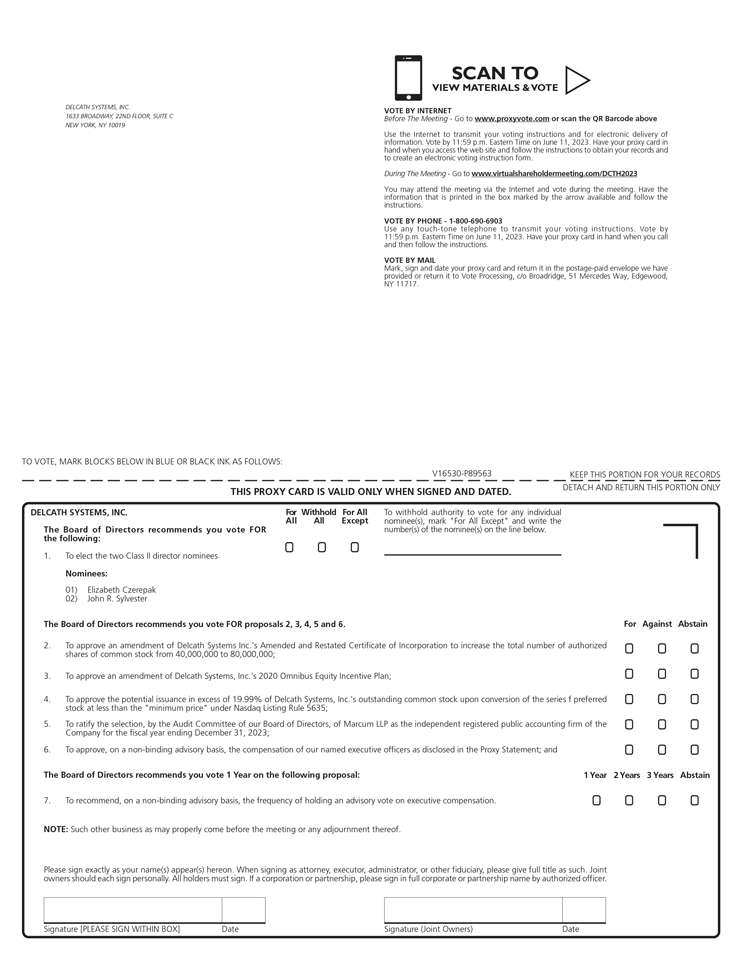

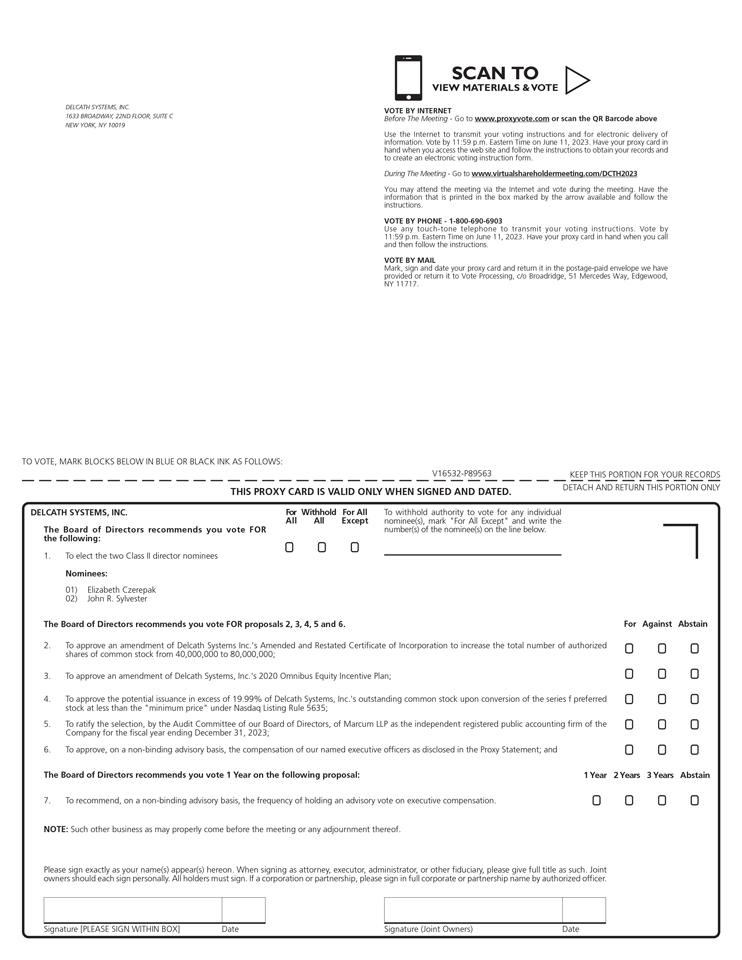

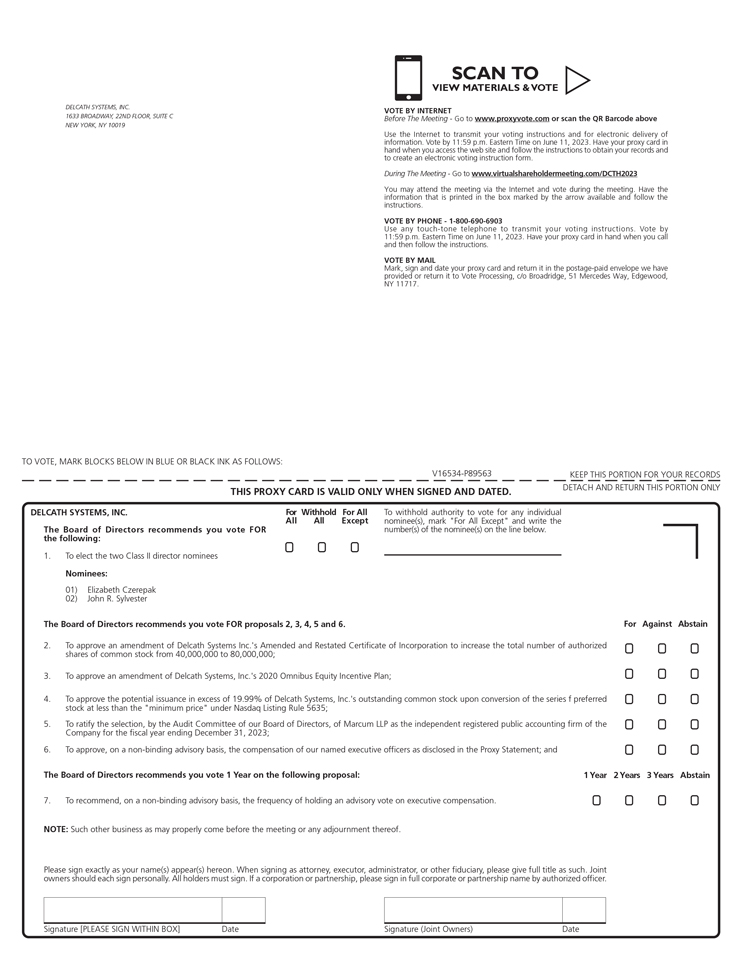

| (1) | to elect Elizabeth Czerepak and John R. Sylvester as Class II directors for a term expiring at the 2026 annual meeting of the Company’s stockholders and until their successors are elected and qualified;

|

| (2) | to approve an amendment of the Company’s Amended and Restated Certificate of Incorporation to increase the total number of authorized shares of common stock, $0.01 par value per share (the “Common Stock”) from 40,000,000 shares to 80,000,000;

|

| (3) | to approve an amendment of the Company’s 2020 Omnibus Equity Incentive Plan to increase by 2,650,000 the number of shares of Common Stock available under thereunder;

|

| (4) | to approve the potential issuance in excess of 19.99% of the Company’s outstanding Common Stock upon the conversion of the Company’s Series F-1 Convertible Preferred Stock, par value $0.01 per share (the “Series F-1 Preferred Stock”), Series F-2 Convertible Preferred Stock, par value $0.01 per share (the “Series F-2 Preferred Stock”), Series F-3 Convertible Preferred Stock, par value $0.01 per share (the “Series F-3 Preferred Stock”) and Series F-4 Convertible Preferred Stock, par value $0.01 per share (the “Series F-4 Preferred Stock” and, together with the Series F-1 Preferred Stock, the Series F-2 Preferred Stock and the Series F-3 Preferred Stock, the “Series F Preferred Stock”) at less than the “minimum price” under Nasdaq Listing Rule 5635(d), and which may be deemed a “change of control” under Nasdaq Listing Rule 5635, pursuant to the terms of the Certificate of Designation of Preferences, Rights and Limitations of Series F Convertible Voting Preferred Stock governing the Series F Preferred Stock;

|

| (5) | to ratify the selection, by the Audit Committee of our Board of Directors, of Marcum LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023;

|

| (6) | to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement (“Proxy Statement”);

|

| (7) | to recommend, on a non-binding advisory basis, the frequency of holding an advisory vote on executive compensation; and

|

| (8) | to transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

|

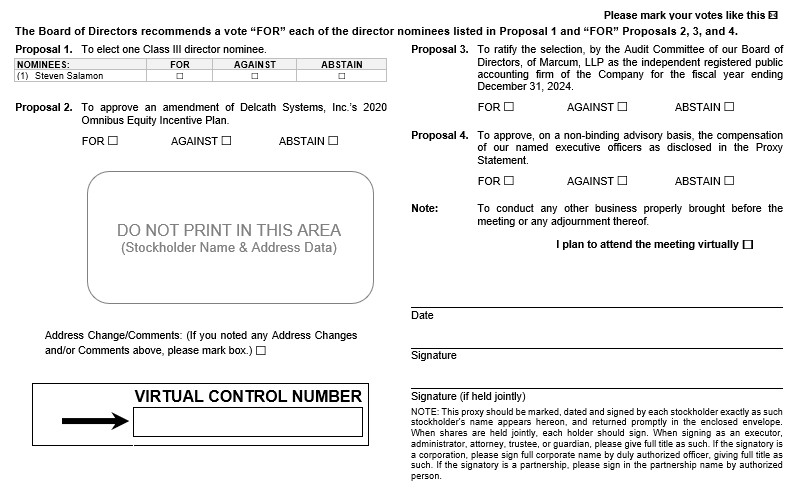

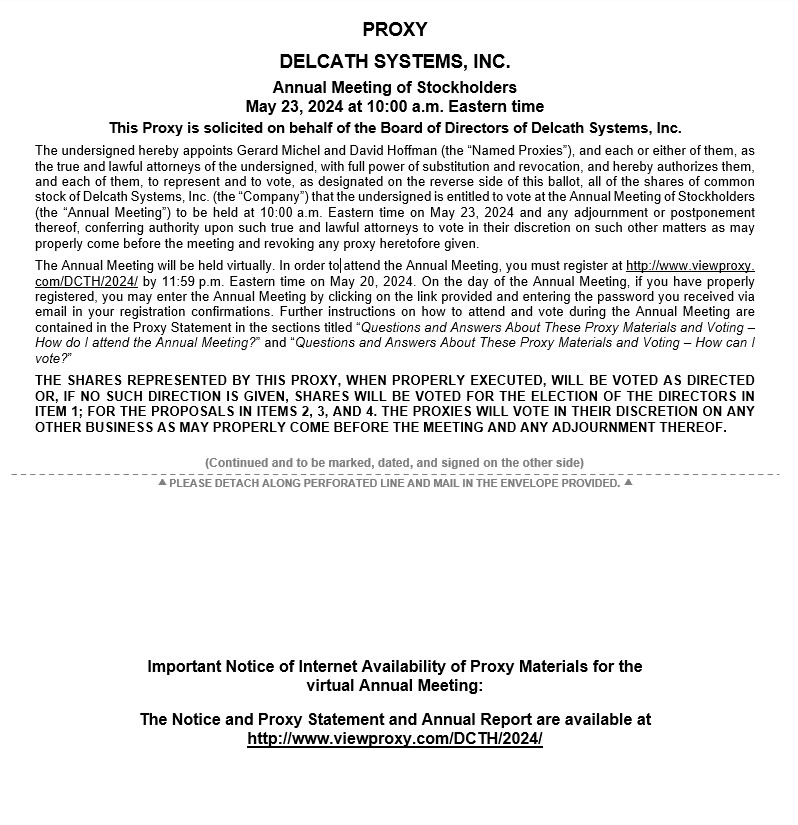

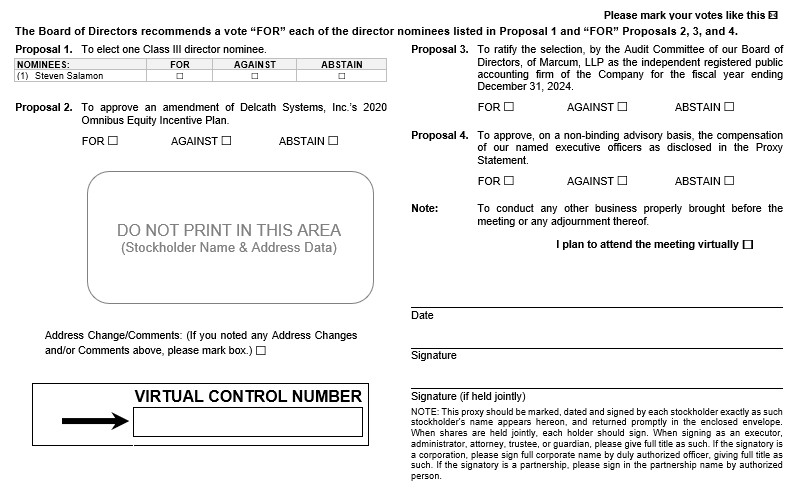

(1)to elect Steven Salamon as a Class III director for a term expiring at the 2027 annual meeting of the Company’s stockholders and until their successors are elected and qualified;

(2)to approve an amendment of the Company’s 2020 Omnibus Equity Incentive Plan to increase by 2,000,000 the number of shares of common stock, $0.01 par value per share (“Common Stock”) available thereunder;

(3)to ratify the selection, by the Audit Committee of our Board of Directors, of Marcum LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024;

(4)to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement (“Proxy Statement”); and

(5)to transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

The matters listed in this Notice are described in detail in the accompanying Proxy Statement. The Board of Directors is not aware of any other business to come before the Annual Meeting.

Our Board of Directors has fixed the close of business on April 21, 2023March 28, 2024 as the record date (the “Record Date”) for determining those stockholders who are entitled to notice of and to vote at the Annual Meeting or any adjournment of our Annual Meeting. Stockholders on the Record Date will be able to attend the Annual Meeting

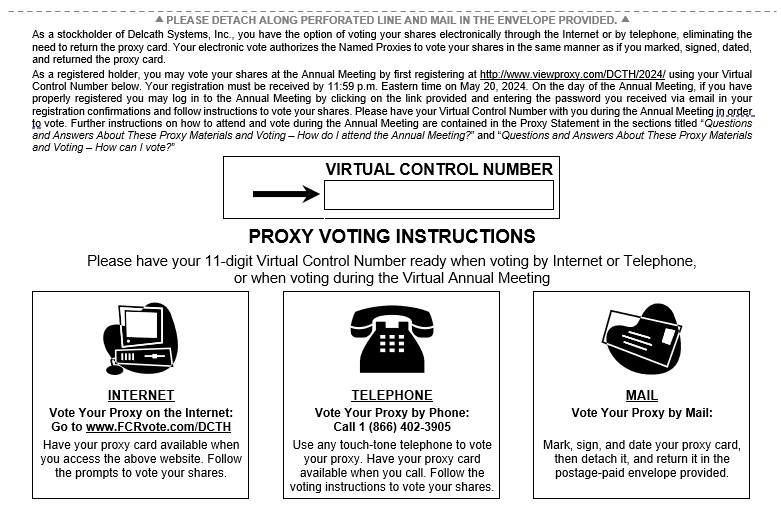

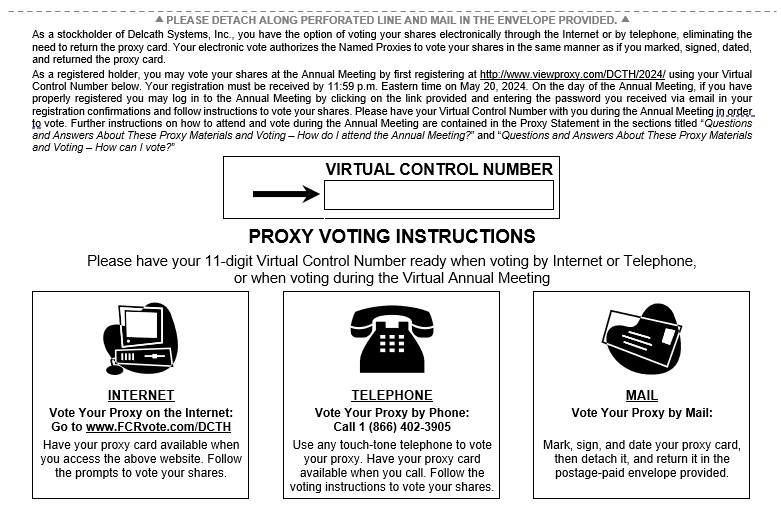

virtually and to vote and submit questionsyour shares during the Annual Meeting by visiting www.virtualshareholdermeeting.com/DCTH2023first registering at http://www.viewproxy.com/DCTH/2024/ and entering the 16-digit control number11-digit Virtual Control Number on the Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

IMPORTANT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

June 12, 2023MAY 23, 2024 at 10:00 a.m. EASTERN TIME This Notice, the accompany 2024Proxy Statement and the Company’s Annual MeetingReport on Form 10-K for the fiscal year ended December 31, 2022,2023, and any other materials concerning the Annual Meeting, together with any amendments to any of these materials, are available on the Internet at www.proxyvote.comhttp://www.viewproxy.com/DCTH/2024/. Your vote is important. Whether or not you plan to attend the Annual Meeting virtually, please vote over the telephone or via the internet as instructed in Notice of Internet Availability of Proxy Materials or by completing, signing and returning the proxy card mailed to

you as promptly as possible to ensure your representation at the Annual Meeting. To ensure that your vote will be counted,

you must register at http://www.viewproxy.com/DCTH/2024/ by 11:59 p.m. Eastern time on May 20, 2024. Once registered, please cast your vote before 11:59 p.m.

(Eastern Time)Eastern Time on

June 11, 2023.May 22, 2024. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Stockholders who attend the Annual Meeting should follow the instructions at

www.virtualshareholdermeeting.com/DCTH2023www.FCRvote.com/DCTH to vote online at the Annual Meeting. Please note, however, that if your shares are held of record by a bank, broker or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

By order of the Board of Directors,

| | | | | | | | |

| | | | | |

| |  | |  |

Queensbury, New York New York | | John R. Sylvester | | Gerard Michel |

May 1, 2023April 12, 2024 | | Chair of the Board | | Chief Executive Officer |

1633 Broadway, Suite 22C

New York, New York 10019

566 Queensbury Avenue,

Queensbury, NY 12804

_____________________

_____________________

INFORMATION ABOUT THE

20232024 ANNUAL MEETING AND VOTING

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Delcath Systems, Inc. (“Delcath,” “we,” “our,” “us” or “the Company”) to be voted at our 20232024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 10:00 a.m. Eastern Time onJune 12, 2023May 23, 2024 in a virtual meeting format only by registering at www.virtualshareholdermeeting.com/DCTH2023.http://www.viewproxy.com/DCTH/2024/. Registration must be received by 11:59 p.m. Eastern time on May 20, 2024. The Board knows of no matters to come before the Annual Meeting other than those described in this Proxy Statement. If any other matters properly come before the Annual Meeting (or any adjournment thereof), the persons named in the proxy card as proxies will vote on such matters in their discretion in accordance with their best judgement. | | | | | | | | |

| Matters to be Voted on at the Annual Meeting. | | At the Annual Meeting, the stockholders of the Company will be asked to consider and take action on the following proposals: |

| (1) to elect Elizabeth Czerepak and John R. SylvesterSteven Salamon as a Class II directorsIII director to hold office

until the 20262027 annual meeting of the Company’s stockholders and until their

successors are elected and qualified (the “Director Election Proposal”); |

| (2) to approve an amendment of the Company’s Amended and Restated Certificate of

Incorporation to increase the total number of authorized shares of Common Stock

from 40,000,000 to 80,000,000 (the “Charter Amendment Proposal”); |

| (3) to approve an amendment to the Company’s 2020 Omnibus Equity Incentive Plan

(the (the “Plan”) to increase by 2,650,0002,000,000 the number of shares of common stock, $0.01

par value per share (the “Common(“Common Stock”) available thereunder (the “Plan

Proposal”);

|

| |

| | (4) to approve the potential issuance in excess of 19.99% of our outstanding Common Stock upon the conversion of the Company’s Series F-1 Convertible Preferred Stock, par value $0.01 per share (the “Series F-1 Preferred Stock”), Series F-2 Convertible Preferred Stock, par value $0.01 per share (the “Series F-2 Preferred Stock”), Series F-3 Convertible Preferred Stock, par value $0.01 per share (the “Series F-3 Preferred Stock”) and Series F-4 Convertible Preferred Stock, par value $0.01 per share (the “Series F-4 Preferred Stock” and, together with the Series F-1 Preferred Stock, the Series F-2 Preferred Stock and the Series F-3 Preferred Stock, the “Series F Preferred Stock”) at less than the “minimum price” under Nasdaq Listing Rule 5635(d) and which may be deemed a “change of control” under Nasdaq Listing Rule 5635(b), pursuant to the terms of the Certificate of Designation of Preferences, Rights and Limitations of Series F Convertible Voting Preferred Stock governing the Series F Preferred Stock (the “Series F Nasdaq Conversion Proposal”);

|

| | |

| | (5)

(3) to ratify the selection, by the Audit Committee of our Board, of Marcum LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 20232024 (the “Ratification Proposal”); |

| | |

| | (6)(4) to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statementproxy statement (the “Say-on-Pay Proposal”);

|

| | (7) to recommend, on a non-binding advisory basis,“Proxy Statement” and such proposal, the frequency of “Say-on-Pay” proposals being submitted to the stockholders at the Company’s annual meetings (the “Frequency of Say-on-Pay“Say-on-Pay Proposal”); and

|

| | (8)

(5) to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

| | | | | | | | |

| Stockholders entitled to vote. | | Only stockholders of record of our Common Stock, our Series E Convertible Preferred Stock, $0.01 par value per share (the “Original Series E Preferred Stock”), our Series E-1 Convertible Preferred Stock, $0.01 par value per share (the “Series E-1 Preferred Stock” and, together with the Original Series E Preferred Stock the “Series E Preferred Stock”) , our Series F-2 Convertible Preferred Stock, $0.01 par value per share (the “Series F-2 Preferred Stock”), and our Series F-1F-3 Convertible Preferred Stock, $0.01 par value per share (the “Series F-3 Preferred Stock” and, together with the Series F-2 Preferred Stock the “Series F Preferred Stock” and together with the Series E Preferred Stock, the “Preferred Stock”) at the close of business on April 21, 2023March 28, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting, but, in the case of the Series E Preferred Stock, subject to the application of the Beneficial Ownership Limitation and, in the case of the Series F-1F Preferred Stock, subject to the Maximum Percentage Limitation and the Share Cap discussed below.Limitation. At the close of business on the Record Date, there were 10,620,462$25,439,319 shares of Common Stock outstanding, 9,605$9,505 shares of our Series E Preferred Stock outstanding, 1,753$1,753 shares of our Series E-1 Preferred Stock outstanding, $2,542 shares of our Series F-2 Preferred Stock outstanding and 24,900$3,010 shares of our Series F-1F-3 Preferred Stock outstanding. See “Number of votes” below for more information. Common Stock:Stock: Each share of our Common Stock outstanding as of the Record Date is entitled to one vote per share on all matters properly brought before the Annual Meeting.

Series E Preferred Stock:Stock: Each share of our Series E Preferred Stock outstanding as of the Record Date has the right to vote on all matters presented to the stockholders for approval, (other than the Charter Amendment Proposal, as described herein), together with the shares of Common Stock and Series F Preferred Stock, voting together as a single class, on an as-converted to Common Stock basis, based on a conversion price of $10.00 per share and stated value of $1,000 per share, subject to the Beneficial Ownership Limitation. The voting of the Series E Preferred Stock is limited by the certificates of designation for such Series E Preferred Stock, which provide that the Company shall not affect any conversion of the Series E Preferred Stock, and a holder of Series E Preferred Stock will not have the right to convert any portion of the Series E Preferred Stock, to the extent that, after giving effect to the conversion, the holder (together with its affiliates and any persons acting as a group together with the holder or any of the holder’s affiliates) (such persons, “Attribution Parties”), would beneficially own in excess of the Beneficial Ownership Limitation. For purposes of determining the Beneficial Ownership Limitation, the number of shares of Common Stock beneficially owned by such holder and its affiliates and Attribution Parties shall include the number of shares of Common Stock issuable upon conversion of the Series E Preferred Stock with respect to which such determination is being made, but will exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted portion of Series E Preferred Stock beneficially owned by such holder or any of its affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company subject to a limitation on conversion or exercise analogous to the limitation contained in the certificate of designations, beneficially owned by such holder or any of its affiliates or Attribution Parties. To the extent that the Beneficial Ownership Limitation applies, the determination of whether the Series E Preferred Stock is convertible (in relation to other securities owned |

| | |

| | by such holder together with any affiliates and Attribution Parties) and of how many shares of Series E Preferred Stock are convertible is in the sole discretion of such holder. The “Beneficial Ownership Limitation” is 4.99% (or, upon written election by a holder which is delivered to the Company prior to the issuance of any shares of Series E Preferred Stock to such holder, 9.99%) of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of Series E Preferred Stock held by the applicable holder. Additional Information regarding the Beneficial Ownership Limitation can be found in the Certificate of Designation of Preferences, Rights and Limitations of Series E Convertible Preferred Stock and Certificate of Designation of Preferences, Rights and Limitations of Series E-1 Convertible Preferred Stock, incorporated by reference as Exhibits 4.1 and 4.2 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 2023. |

| | | | | | | | |

| Series F-1F Preferred Stock: Each share of our Series F-1F Preferred Stock outstanding as of the Record Date has the right to vote on all matters presented to the stockholders for approval, (other than the Charter Amendment Proposal and the Series F Nasdaq Conversion Proposal, as described herein), together with the shares of Common Stock and Series E Preferred Stock (subject to the Beneficial Ownership Limitation), voting together as a single class, on an as-converted to Common Stock basis, based on a conversion priceas determined by dividing the Liquidation Preference (as defined in the Series F Certificate of $3.30Designation, and which is three times the original per share and stated valueprice of $1,000 per share, together with any dividends declared but unpaid thereon) by the voting conversion price, which is the lower of (i) the Nasdaq Official Closing Price of the Common Stock immediately preceding March 27, 2023 (or $4.84) and (iii) the average Nasdaq Official Closing Price of the Common Stock for the five trading days immediately preceding March 27, 2023 (or $4.58) (such conversion mechanism, the “Voting Conversion Mechanism”), subject to the Maximum Percentage Limitation and Share Cap.Limitation. The voting of the Series F-1F Preferred Stock is limited by the Series F Certificate of Designation (as defined below), which provides that the Company shall not affect any conversion of the Series F-1F Preferred Stock, and the portion of the Series F-1F Preferred Stock shall not automatically convert, to the extent that, after giving effect to the conversion, the holder and its affiliates and Attribution Parties would beneficially own in excess of the Maximum Ownership Limitation. For purposes of determining the Maximum Ownership Limitation, the number of shares of Common Stock beneficially owned by such holder and its affiliates and Attribution Parties shall include the number of shares of Common Stock issuable upon conversion of the Series F-1F Preferred Stock with respect to which such determination is being made, but will exclude the number of shares of Common Stock which are issuable upon (i) exercise of the remaining unconverted portion of the Series F-1F Preferred Stock beneficially owned by such holder or any of its affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company subject to a limitation on conversion or exercise analogous to the limitation contained in the Series F Certificate of Designation, beneficially owned by such holder or any of its affiliates or Attribution Parties. To the extent that the Maximum Ownership Limitation applies, the determination of whether the Series F-1F Preferred Stock is convertible (in relation to other securities owned by such holder together with any affiliates and Attribution Parties) and of how many shares of Series F-1F Preferred Stock are convertible is in the sole discretion of such holder. The “Maximum Ownership Limitation” is 9.99% (or, upon written election by a holder which is delivered to the Company prior to the issuance of any shares of Series F-1F Preferred Stock to such holder, any other percentage not in excess of 19.99% of the issued and outstanding Common Stock immediately after giving effect to the issuance of Common Stock issuable upon conversion of the Series F-1F Preferred Stock if exceeding that limit would result in a change of control under Nasdaq Listing Rule 5635(b)) of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of Series F-1F Preferred Stock held by the applicable holder. In addition, until the Series F Nasdaq Conversion Proposal is approved by the requisite vote of our stockholders, the number of shares of Common Stock that shall be deemed issued upon conversion of the Series F-1 Preferred Stock (for purposes of calculating the aggregate votes the holders of Series F-1 Preferred |

| | |

| | Stock are entitled to on an as-converted Common Stock basis) will be equal to the number of shares of Common Stock equal to 19.9% of the Company’s outstanding Common Stock on March 27, 2023 (or 2,016,327 shares of Common Stock). We refer to this limitation as the “Share Cap.”

Additional Information regarding the Maximum Ownership LimitationSeries F Preferred Stock and the Share Capterms thereof can be found in the Certificate of Designation of Preferences, Rights and Limitations of Series F Convertible Voting Preferred Stock (the “Series F Certificate of Designation”), incorporated by reference as Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SECSecurities and Exchange Commission (the “Commission”) on March 29, 2023. Under the applicable Nasdaq listing rules, shares of the Series F-1 Preferred Stock are not entitled to vote on the Series F Nasdaq Conversion Proposal.

The Series E Preferred Stock and Series F Preferred Stock are collectively referred to herein as the “Preferred Stock.” A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for ten days prior to the Annual Meeting for any purposes germane to the Annual Meeting between the hours of 9:00 a.m. and 5:00 p.m., at our principal executive offices at 1633 Broadway, Suite 22C, New York, New York 10019,566 Queensbury Avenue, Queensbury, NY 12804, by contacting the Secretary of the Company. |

| | | | | | | | |

| Number of votes. | | Holders of Common Stock have one vote for each share of Common Stock held and holders of Preferred Stock are entitled to vote with the holders of shares of Common Stock, and not as a separate class, on an as-converted to Common Stock basis, subject to, with respect to the Series E Preferred Stock, the Beneficial Ownership Limitation and, with respect to the Series F-1F Preferred Stock, the Maximum Ownership Limitation and other than, with respect to the Preferred Stock, the Charter Amendment Proposal, and with respect to the Series F-1 Preferred Stock, the Series F Nasdaq Conversion Proposal.Limitation. As of the Record Date, 25,439,319 shares of Common Stock are issued and outstanding. In addition, the following shares of Preferred Stock are issued and outstanding: • 10,620,462 shares of Common Stock;• 9,605

9,505 shares of Original Series E Preferred Stock that are convertible into an aggregate of 45,600 shares of Common Stock,where 950,465 have voting rights after taking into account the Beneficial Ownership Limitation; • 1,753 shares of Series E-1 Preferred Stock that are convertible into an aggregate of 0 shares of Common Stock,where 175,256 have voting rights after taking into account the Beneficial Ownership Limitation; and • 24,900 2,542 shares of Series F-1F-2 Preferred Stock that are convertible into an aggregate of 1,378,788 shares of Common Stock,where 868,539 have voting rights, as calculated in accordance with Voting Conversion Mechanism, after taking into account the Maximum PercentageOwnership Limitation; and •3,010 shares of Series F-3 Preferred Stock none of which are eligible to vote after taking into account the Share Cap.Maximum Ownership Limitation. Therefore, for purposes of the Director Election Proposal, the Plan Proposal, the Ratification Proposal, the Say-on-Pay Proposal and the Frequency of Say-on-Pay Proposal, there are 12,440,85027,433,579shares of Common Stock entitled to vote as of the Record Date, consisting of all shares of Common Stock outstanding and all shares of Preferred Stock on an as-converted to Common Stock basis. For purposes of the Charter Amendment Proposal, there are 10,620,462 shares entitled to vote as of the Record Date, consisting of all shares of Common Stock outstanding. For purposes of the Series F Nasdaq Conversion Proposal, there are 10,666,062 shares entitled to vote as of the Record Date, consisting of all shares Common Stock outstanding and all shares of Series E Preferred Stock on an as-converted Common Stock basis. |

Date. | | |

| | |

| Attending the virtual meeting. | | Stockholders of record as of April 21, 2023March 28, 2024 will be able to participate in the Annual Meeting by visiting our 20232024 Annual Meeting website at www.virtualshareholdermeeting.com/DCTH2023.http://www.viewproxy.com/DCTH/2024/. To participate in the Annual Meeting, you will need the 16-digit11-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. You must register by 11:59 p.m. Eastern time on May 20, 2024. The Annual Meeting will begin promptly at 10:00 a.m. Eastern time on June 12, 2023.May 23, 2024. Online check-in will begin at 9:45 a.m. Eastern time on June 12, 2023,May 23, 2024, and you should allow approximately 15 minutes for the online check-in procedures. |

| | | | | | | | |

| How to vote. | | Whether or not you plan to virtually attend the Annual Meeting and regardless of the number of shares of the Company’s Common Stock and/or Preferred Stock that you own, please vote as soon as possible.

Stockholder of Record: Shares Registered in Your Name If, on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer and Trust Company,Equiniti, LLC, you are a stockholder of record. As a stockholder of record, you may vote online during the Annual Meeting, vote by proxy through the internet or telephone or vote by proxy using a proxy card that you may request or that was delivered to you. Whether or not you intend to attend the Annual Meeting, we urge you to vote by proxy through the internet or telephone as instructed below, or by completing a proxy card as soon as possible. You may vote using the following methods: |

|  | | Go to http://www.proxyvote.comwww.FCRvote.com/DCTH to complete an electronic proxy card. You

will be asked to provide the 16-digit control number included on your Notice,

your proxy card (that you may request or that was delivered to you) or the

instructions that accompanied your proxy materials. Your vote must be

received by 11:59 p.m. (Eastern Time) on June 11, 2023 to be counted. |

|  | | Dial 1-800-690-6903 using a touch-tone phone and following the recorded instructions. You will be asked to provide the 16-digit11-digit control number included on your Notice, your proxy card (that you may request or that was delivered to you) or the instructions that accompanied your proxy materials. Your vote must be received by 11:59 p.m. (Eastern Time) on June 11, 2023, May 22, 2024 to be counted. |

|  Dial 1-866-402-3905 using a touch-tone phone and following the recorded instructions. You will be asked to provide the 11-digit control number included on your Notice, your proxy card (that you may request or that was delivered to you) or the instructions that accompanied your proxy materials. Your vote must be received by 11:59 p.m. (Eastern Time) on May 22, 2024, to be counted. |

| | Complete, sign, date and return the proxy card that you may request or that was delivered to you and return it promptly in the envelope provided. If you return your signed proxy card to use before the Annual Meeting, your shares will be voted as you direct. |

| | |

| | In addition, you may vote online beforeduring the Annual Meeting. To do so, during the Annual Meeting, visit our Annual Meeting website at www.virtualshareholdermeeting.com/DCTH2023.http://www.viewproxy.com/DCTH/2024/. You will be asked to provide the 16-digit11-digit control number included on your Notice, your proxy card that you request or that was delivered to you or the instructions that accompanied your proxy materials. Once you have logged onto the Annual Meeting, please follow the instructions to vote your shares. If you do not have your 16-digit11-digit control number, you will be able to access and listen to the Annual Meeting, but you will not be able to vote your shares or submit questions. |

You must register by 11:59 p.m. Eastern time on May 20, 2024 to vote your shares at the Annual Meeting. | | |

| | Beneficial Ownership: Shares Registered in the Name of Bank, broker or other nominee If, on the Record Date, your shares were held not in your name, but rather in an account at a bank, broker or other nominee, then you are the beneficial owner of shares held in “street name.” Your bank, broker or other nominee is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you should have received a notice containing voting instructions from your bank, broker or other nominee rather than from us. Simply follow the instructions in the notice to ensure that your vote is counted. Please also note that since you are not the stockholder of record, you may only vote your shares during the Annual Meeting if you request and obtain a valid 16-digit11-digit control number from your bank, broker or other nominee. Beneficial owners who attend the Annual Meeting should follow the instructions at www.virtualshareholdermeeting.com/DCTH2023http://www.viewproxy.com/DCTH/2024/ to vote during the Annual Meeting. If your shares are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company,Equiniti, LLC, you are a stockholder of record. As a stockholder of record, you may vote online during the Annual Meeting, vote by proxy through the internet or telephone or vote by proxy using a proxy card that you may request or that was delivered to you. Whether or not you intend to attend the Annual Meeting, we urge you to vote by proxy through the internet or telephone as instructed below, or by completing a proxy card as soon as possible. |

| | | | | | | | |

| | |

| Quorum. | | The presence at the Annual Meeting, in person virtually or represented by proxy, of the holders of a majority of the shares of the Company’s Common Stock and Preferred Stock (on an as-converted to Common Stock basis, subject to the Beneficial Ownership Limitation with respect to the Series E Preferred Stock and the Maximum Ownership Limitation and Share Cap with respect to the Series F-1F Preferred Stock) issued and outstanding and entitled to vote at the Annual Meeting will constitute a quorum for purposes of voting at the Annual Meeting. Attendance at the Annual Meeting, albeit virtual, constitutes presence in person for purposes of a quorum. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining the existence of a quorum. |

| | |

| Broker non-votes. | | A broker “non-vote”“non-vote” occurs when a nominee, such as a bank or broker, holding shares in “street name” for a beneficial owner, returns the proxy but abstains from voting on a particular proposal because, under most circumstances, such nominee does not have discretionary authority to vote on proposals unless it has received instructions from the beneficial owner of the securities on how to vote those securities. Under applicable rules, such nominees do not have discretionary authority to cast votes on non-routine matters without instructions from the beneficial owner of the securities. If you do not provide your bank, broker or other nominee with instructions on how to vote your shares held in “street name,” your bank, broker or other nominee will have discretionary authority to vote your shares with respect to “routine” proposals, but not with respect to “non-routine”“non-routine” proposals. •Routine proposal. We have been advised by the New York Stock Exchange (“NYSE”) that the Ratification Proposal is a routine proposal and may be voted upon by your bank, broker or other nominee if you do not submit voting instructions to your bank, broker or other nominee. •Non-routine proposals. We have been advised by the NYSE that the Director Election Proposal, the Charter Amendment Proposal, the Plan Proposal, the Say-on-Pay Proposal and the Frequency of Say-on-Pay Proposal are non-routine proposals and may not be voted upon by your bank, broker or other nominee in the absence of specific instructions from you as to how you |

| | |

| | would like your shares to be voted. If you hold your shares in “street“street name,,” we strongly encourage you to provide instructions regarding the voting of your shares because your bank, broker or other nominee cannot vote your shares with respect to these proposals without voting instructions from you. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Vote required;

treatment of

abstentions and

broker non-votes. | | Proposal | | Proposal

| Vote Required to Adopt the Proposal | | Effect of

Abstentions /

Withheld Votes

| |

Effect of “Broker

Non-Votes” |

| | Proposal 1 – Director Election Proposal | | Nominees receiving the most “FOR” votes from the holders of shares present or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “FOR” will affect the outcome. For purposes of the Director Election Proposal, shares of Common Stock and Preferred Stock will vote together as a single class with the holders of Preferred Stock voting on an as-converted to Common Stock basis, subject, with respect to the Series E Preferred Stock, to the Beneficial Ownership Limitation and, with respect to the Series F-1F Preferred Stock, to the Maximum Ownership Limitation and the Share Cap.Limitation. | | No effect. | | No effect. |

| | | | |

| | Proposal 2 – Charter Amendment Proposal | | The Charter Amendment Proposal must receive “FOR” votes from the holders present or represented by proxy of the majority of the outstanding shares entitled to vote on the matter.

For purposes of the Charter Amendment Proposal, only shares of Common Stock are entitled to vote. The Preferred Stock may not vote on this matter.

| | An abstention will have the same effect as a vote “AGAINST” the Charter Amendment Proposal. | | A broker non-vote will have the same effect as a vote “AGAINST” the Charter Amendment Proposal.(1) |

| | | | | | | | |

Vote required;

treatment of

abstentions and

broker

non-votes. | | Proposal

| | Vote Required to Adopt the Proposal

| | Effect of

Abstentions /

Withheld Votes

| | Effect of “Broker

Non-Votes”

|

| | | | |

| | Proposal 3 – Plan Proposal | | The Plan Proposal must receive “FOR” votes from the majority of shares present or represented by proxy and entitled to vote on the matter. For purposes of the Plan Proposal, shares of Common Stock and Preferred Stock will vote together as a single class with the holders of Preferred Stock voting on an as-converted to Common Stock basis, subject, with respect to the Series E Preferred Stock, to the Beneficial Ownership Limitation and, with respect to the Series F-1F Preferred Stock, to the Maximum Ownership Limitation and the Share Cap.Limitation. | | An abstention will have the same effect as a vote “AGAINST” the Plan Proposal. | | No effect. |

| | | | |

| | Proposal 4 – Series F Nasdaq Conversion Proposal | | The Series F Nasdaq Conversion Proposal must receive “FOR” votes from the holders of a majority of votes cast on the proposal.

For purposes of the Series F Nasdaq Conversion Proposal, shares of Common Stock and Series E Preferred Stock will vote together as a single class with the holders of Series E Preferred Stock voting on an as-converted to Common Stock basis, subject to, with respect to the Series E Preferred Stock, the Beneficial Ownership Limitation. Under the applicable Nasdaq listing rules, shares of Series F Preferred Stock are not entitled to vote on the Series F Nasdaq Conversion Proposal.

| | No effect. | | No effect. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Vote required;

treatment of

abstentions and

broker

non-votes. | | Proposal | | Proposal

| Vote Required to Adopt the Proposal | | Effect of

Abstentions /

Withheld Votes

| |

Effect of “Broker

Non-Votes” |

| | | | |

| | Proposal 53 -Ratification Proposal | | The Ratification Proposal must receive “FOR” votes from the holders of a majority of shares present or represented by proxy and entitled to vote on the proposal. For purposes of the Ratification Proposal, shares of Common Stock and Preferred Stock will vote together as a single class with the holders of Preferred Stock voting on an as-converted to Common Stock basis, subject, with respect to the Series E Preferred Stock, to the Beneficial Ownership Limitation and, with respect to the Series F-1F Preferred Stock, to the Maximum Ownership Limitation and the Share Cap.Limitation. | | An abstention will have the same effect as a vote “AGAINST” the proposal. | | Not applicable; brokers have discretion to vote. |

| | Proposal 4 -Say-on-Pay Proposal | | | | |

| | Proposal 6 -Say-on-Pay Proposal | | The Say-on-Pay Proposal must receive “FOR” votes from the holders of a majority of shares present or represented by proxy and entitled to vote on the matter. For purposes of the Say-on-Pay Proposal, shares of Common Stock and Preferred Stock will vote together as a single class with the holders of Preferred Stock voting on an as-converted to Common Stock basis, subject, with respect to the Series E Preferred Stock, to the Beneficial Ownership Limitation and, with respect to the Series F-1F Preferred Stock, to the Maximum Ownership Limitation and the Share Cap.Limitation. | | An abstention will have the same effect as a vote “AGAINST” the proposal. | | No effect. |

| | | | | | | | |

Vote required;

treatment of

abstentions and

broker

non-votes. | | Proposal

| | Vote Required to Adopt the Proposal

| | Effect of

Abstentions /

Withheld Votes

| | Effect of “Broker

Non-Votes”

|

| | | | |

| | Proposal 7 – Frequency of Say-on-Pay Proposal | | The frequency receiving the majority of votes from the holders of shares present or represented by proxy and entitled to vote, if any, will be deemed to be the choice of the stockholders.

For purposes of the Frequency of Say-on-Pay Proposal, shares of Common Stock and Preferred Stock will vote together as a single class with the holders of Preferred Stock voting on an as-converted to Common Stock basis, subject, with respect to the Series E Preferred Stock, to the Beneficial Ownership Limitation and, with respect to the Series F-1 Preferred Stock, to the Maximum Ownership Limitation and the Share Cap.

| | An abstention will have the same effect as a vote “AGAINST” each of the voting frequencies. | | No effect. |

| |

| | (1) While similar proposals are typically considered to be “routine” matters under NYSE rules, we have been advised by the NYSE that this proposal is considered to be a “non-routine” matter under NYSE rules given our current lack of sufficient unissued and unreserved shares of Common Stock to effect the issuance of any shares pursuant to the proposed share increase under the Plan Proposal (the Plan Proposal is also considered to be a non-routine matter). Accordingly, we expect broker non-votes to exist with respect to this proposal.

|

| | |

Voting recommendation of the Board of Directors;Board; voting of proxies. | | With respect to the proposal concerning the frequency of advisory votes on executive compensation, the Board recommends that the advisory vote take place every “ONE”year. The Board recommends a vote “FOR” each of the other proposals. Your shares will be voted in accordance with the instructions contained in your signed proxy card. If you return a signed proxy card without giving specific voting instructions with respect to each proposal, proxies will be voted in favor of the Board’sBoard’s recommendations with respect to the proposals as set forth in this Proxy Statement. |

| | |

| |

| How to revoke your proxy. | | Your proxy is revocable. The procedure you must follow to revoke your proxy depends on how you hold your shares. If you are a registered holder of our Common Stock or Preferred Stock, you may revoke a previously submitted proxy by submitting another valid proxy (whether by telephone, the Internet or mail) or by providing a signed letter of revocation to the Corporate Secretary of the Company before the closing of the polls at the virtual annual meeting on June 11, 2023.May 23, 2024. Only the latest-dated validly executed proxy will count. You also may revoke any previously submitted proxy and vote your shares online during the virtual annual meeting; however, simply attending the Annual Meeting in virtual format without taking one of the above actions will not revoke your proxy. If you hold shares in “street name,” in general, you may revoke a previously submitted voting instruction by submitting to your bank, broker or other nominee another valid voting instruction (whether by telephone, the Internet or mail) or a signed letter of revocation. Please contact your bank, broker or other nominee for detailed instructions on how to revoke your voting instruction and the applicable deadlines. Please note that your attendance at the virtual annual meeting in and of itself will not be sufficient to revoke your proxy. |

| | |

| |

| Expenses and solicitation. | | We will bear the cost for the solicitation of proxies, including printing and mailing costs. In addition to the solicitation of proxies by mail, proxies may also be solicited personally by directors, officers and employees of Delcath, without additional compensation to these individuals. We will request that banks, brokers and other firms holding shares in their names that are beneficially owned by others forward proxy materials to and obtain proxies from such beneficial owners, and will, upon request, reimburse such banks, brokers and other firms for their reasonable out-of-pocket costs. We have engaged Alliance Advisors, LLC (“Alliance”) as the proxy solicitor for the Annual Meeting for a base fee of $35,000, plus fees for additional services. We have agreed to reimburse Alliance for its reasonable out of pocket expenses. If you have questions about the proposals or if you need copies of this Proxy Statement or a proxy card, you should contact: 200 Broadacres Drive, 3rd Floor DCTH@allianceadvisors.com |

| |

| Other matters. | | We are not aware of any matters to be presented at the Annual Meeting other than those described in this Proxy Statement. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned or postponed, the proxy holders can vote your shares at the new meeting as well unless you have subsequently revoked your proxy. |

| |

| Vote results. | | The preliminary results of the voting on the proposals will be reported at the Annual Meeting. The final certified results of the voting will be reported in a Current Report on Form 8-K within four business days after the Annual Meeting. |

| | |

| |

| Who should I call if I have additional questions? | | If you need assistance with voting or have questions regarding the Annual Meeting, please contact: 200 Broadacres Drive, 3rd Floor DCTH@allianceadvisors.com |

PROPOSAL 1: ELECTION OF

TWOONE CLASS

II DIRECTORSIII DIRECTOR

Our certificate of incorporation and bylaws, each as currently amended and in effect, state that our Board will consist of a number of directors that will be fixed exclusively by the Board from time to time in accordance with the bylaws of the Company. Our Board has fixed the number of directors comprising the Board at six members. Each director holds office until his or her successor is duly elected and qualified or until his or her death, incapacity, resignation or removal. Any vacancy in the Board, including a vacancy that results from an increase in the number of directors, may be filled only by the vote of a majority of the remaining directors then in office. Our certificate of incorporation also provides that our Board is divided into three classes of directors, with the classes as nearly equal in number as possible. Subject to any earlier resignation or removal in accordance with the terms of our certificate of incorporation and bylaws, our current Class

II directors,III director, if elected, will serve until the Company’s

20262027 annual meeting of stockholders; our current Class I directors will serve until the 2025 annual meeting of stockholders; and our current Class

IIIII directors will serve until the

20242026 annual meeting of stockholders. Any additional directorships resulting from an increase in the number of directors will be apportioned by our Board among the three classes as equally as possible.

Our Board has nominated

Elizabeth Czerepak and John R. SylvesterSteven Salamon for election as Class

II directorsIII director at the Annual Meeting, to serve until the Company’s

20262027 annual meeting of stockholders.

Both of the nominees areThe nominee is presently

directors,a director, and

both havehas indicated a willingness to continue to serve as director, if elected. If a nominee becomes unable or unwilling to serve, proxies may be voted for substitute nominees selected by our Board.

Nominees

Nominee for Election as Class

II Directors | | | | | | |

Name | | Age | | Position with Delcath | | Director Since |

Elizabeth Czerepak | | 67 | | Director | | 2020 |

John R. Sylvester | | 59 | | Non-Executive Chairman | | 2019 |

III Director

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position with Delcath | | Director Since |

| Steven Salamon | | 58 | | Director | | 2020 |

Biographical information, including principal occupation and business experience during the last five years, for our director

nomineesnominee is set forth below.

Elizabeth Czerepakwas appointed as a director of the Company in February 2020. Ms. Czerepak serves as Chief Financial Officer at BeyondSpring Inc. (NASDAQ:BYSI), a global biopharmaceutical company focused on developing innovative immuno-oncology cancer therapies, since September 2020. Prior to that, from May 2018 to January 2020, she served as Chief Financial Officer and Chief Business Officer of Genevant Sciences, Inc., a technology focused nucleic acid delivery company. Earlier experience includes CFO roles at other biotechnology companies including Altimmune, Inc. (NASDAQ: ALT), Isarna Therapeutics, and Cancer Genetics (NASDAQ: CGIX), where she led Altimmune’s IPO through reverse merger, and Cancer Genetics’ IPO and subsequent uplisting to NASDAQ. She has extensive experience in biotech venture capital investment as a Managing Director at JP Morgan/Bear Stearns, where she led investments in 13 biotechs, providing primary support in completing large private financings, and exits through IPO and acquisition. Elizabeth began her career serving in senior and executive level positions for 18 years at BASF Pharma, Hoffmann-La Roche, and Merck & Co. Her pharma executive level experience includes M&A, licensing, business development and finance. Ms. Czerepak also serves on the board of directors of Sorrento Therapeutics, Inc. (NASDAQ: SRNE) since November 2021. Ms. Czerepak served as a director of Spectrum Pharmaceuticals, Inc. (NASDAQ: SPPI) from June 2019 to December 2020, and as a director of Scilex Pharmaceuticals, Inc., a private company, from 2019 to 2020. Earlier, from 2001 to 2010, Ms. Czerepak served as a director for many, mostly private, companies in which she was an investor. She received a B.A. magna cum laude in Spanish and Mathematics Education from Marshall University and an MBA from Rutgers University. In 2020, Elizabeth earned a Corporate Director Certificate from Harvard Business School.

Ms. Czerepak brings to our Board extensive experience in the pharmaceutical and biotech industries, including as a senior finance executive of publicly traded biopharmaceutical companies.

John R. Sylvester was appointed as a director of the Company in July 2019. He has served as Non-Executive Chairman of the Board of Directors of the Company since February 2023. He is currently serving as CEO of Curium Pharma’s SPECT and International businesses. Prior to that he served as Chief Commercial Officer of BTG plc, which he joined in 2011 and had roles leading both their Interventional Oncology and Interventional Vascular businesses as well as a period as Chief Development Officer accountable for Strategy, M&A and Market access. This culminated in an exit to Boston Scientific for $4.2 billion. Prior to BTG, John was Managing Director of Biocompatibles plc (“Biocompatibles”), building their Interventional Oncology business which led to a successful exit to BTG for £166.0 million. John joined Biocompatibles following a period as the Vice President of Marketing for Baxter Healthcare’s $750.0 million European Medication Delivery business based in Brussels, then Zurich, accountable for six strategic business units incorporating drugs, devices and drug device combinations. Before this, John held a number of senior commercial roles in the industrial sector. Immediately prior to Baxter Healthcare, John was the General Manager of a minerals company with assets on three continents, $500.0 million of sales and 1,500 employees. John graduated with joint honors in Biochemistry and Applied Molecular Biology from the University of Manchester.

Mr. Sylvester’s extensive international experience with business strategy and commercialization in the healthcare space as well as his educational background enhances our Board.

Vote Required

The affirmative vote of a plurality of our shares of Common Stock and Preferred Stock voting together as a single class with the holders of the Preferred Stock voting on an as-converted to Common Stock basis, present or represented by proxy at the Annual Meeting and entitled to vote, is required with respect to this proposal.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE TWO CLASS II DIRECTOR NOMINEES.

Directors Continuing in Office

| | | | | | |

Name | | Age | | Position with Delcath | | Director Since |

Gerard Michel | | 59 | | CEO/Director | | 2020 |

Gilad Aharon, PhD | | 49 | | Director | | 2020 |

Roger G. Stoll, Ph.D. | | 80 | | Director | | 2008 |

Steven Salamon | | 57 | | Director | | 2020 |

Biographical information, including principal occupation and business experience during the last five years, for our directors whose terms continue is set forth below.

Class III Directors (Term Expires at 2024 Annual Meeting)

Roger G. Stoll, Ph.D. was appointed as a director of the Company in December 2008. He became Executive Chairman in September 2014 and served as Chairman of the Board from October 2015 until February 2023. From 2002 to 2010 he served as Chairman and Chief Executive Officer of Cortex Pharmaceuticals, Inc. (now RespireRx Pharmaceuticals Inc.) (“Cortex”). In August 2010 he was appointed Executive Chairman of the board of directors of Cortex and served in such role until his retirement in 2012. From 2001 to 2002 he was a consultant to several east coast venture capital firms and startup ventures. From 1998 to 2001, he was Executive Vice President of Fresenius Medical Care-North America, in charge of the dialysis products division and the diagnostic business units, which included hemodialysis machines, dialysis filters, dialysate solutions, and

attendant devices used in the dialysis procedure. From 1991 to 1998, Dr. Stoll was Chief Executive Officer of Ohmeda, a global leader in anesthetic agents, critical care drugs and related operating room devices with sales of $1 billion annually. From 1994 until the sale of Ohmeda in 1998, he was also a member of the board of directors of The BOC Group, plc in London, UK (now part of Linde). From 1986 to 1991, Dr. Stoll held several positions of increasing responsibility at Bayer, AG, including Chief Administrative Officer, President of Bayer’s Consumer Healthcare business unit, and Executive Vice-President and General Manager for its worldwide Diagnostic Business Group, which included the acquisition of Cooper Technicon and the global integration of the Bayer and Technicon business units and resulted in a global diagnostic business in excess of $1 billion in sales annually. Prior to that he worked for American Hospital Supply Corporation, where he rose from Director of Clinical Pharmacology to President of the American Critical Care Drug division. Mr. Stoll began his pharmaceutical career at the Upjohn Company working in drug metabolism and pharmacokinetic studies in a clinical development unit in 1972. Dr. Stoll obtained his BS in Pharmacy at Ferris State University, his PhD in Biopharmaceutics and Drug Metabolism at the University of Connecticut and was a post-doctoral fellow for two years at the University of Michigan. He served on the board of directors of Questcor Pharmaceuticals from 1999 to 2005 and on the boards of Agensys, Inc. from 2003 until its sale to Astellas in late 2007 and Chelsea Therapeutics from 2008 until it was acquired in 2014 by Lundbeck A/S. From 1991 to 2002, Dr. Stoll also served on the board of directors of St. Jude Medical (1991 to 2001) and the industry boards HIMA and PMA (now PhRMA). Dr. Stoll also serves on the University of Connecticut School of Pharmacy Advisory Board.

Dr. Stoll possesses decades of business management experience, including tenures as chairman and chief executive officer, in the pharmaceutical and medical devices and equipment industries and his service on the boards of other companies has allowed him to gain broad-based experience and sensitivity regarding best practices, which he shares with our Board. Dr. Stoll’s many years of Board service to our Company is extremely valuable providing not only his own perspective but legacy knowledge as well.

Steven Salamon was appointed as a director of the Company in May 2020. Mr. Salamon is a co-founder of, and has served as Portfolio Manager at, Rosalind Advisors, Inc., a life sciences-focused investment manager (“Rosalind Advisors”), since 2006. Mr. Salamon holds an MBA from the Ivey Business School and a Bachelors of Applied Science degree in Engineering Physics from the University of Toronto. Prior to co-founding Rosalind Advisors, Mr. Salamon worked as an equity analyst at HSBC Securities and RBC Capital Markets (formerly RBC Dominion Securities). Prior to completing his MBA, Mr. Salamon worked as a product engineer for Chrysler Corporation.

Mr. Salamon brings to our Board his manufacturing, financial and investment industry experience, his understanding of our business and our industry and his strategic insight. In addition, Mr. Salamon provides a valuable stockholder perspective to the Board. Mr. Salamon was elected to our Board pursuant to a Board Appointment Agreement entered into with certain of our stockholders, Rosalind Master Fund L.P. and Rosalind Opportunities Fund I L.P.

Vote Required

The affirmative vote of a plurality of our shares of Common Stock and Preferred Stock voting together as a single class with the holders of the Preferred Stock voting on an as-converted to Common Stock basis, present or represented by proxy at the Annual Meeting and entitled to vote, is required with respect to this proposal.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE ONE CLASS III DIRECTOR NOMINEE.

Directors Continuing in Office

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position with Delcath | | Director Since |

| Gerard Michel | | 60 | | CEO/Director | | 2020 |

| Gilad Aharon, Ph.D. | | 50 | | Director | | 2020 |

| Elizabeth Czerepak | | 68 | | Director | | 2020 |

| John R. Sylvester | | 60 | | Non-Executive Chairman | | 2019 |

Biographical information, including principal occupation and business experience during the last five years, for our directors whose terms continue is set forth below.

Class I Directors (Term Expires at 2025 Annual Meeting)

Gerard Michel was appointed as a director of the Company and its Chief Executive Officer in October 2020. Mr. Michel has over 30 years of experience in the pharmaceutical and medical technology industries across multiple functional areas. Prior to joining the Company as its Chief Executive Officer on October 1, 2020, he was Chief Financial Officer of Vericel Corporation, a biopharmaceutical company, since June 2014 where he was a key member of the management team that integrated a transformative acquisition and revised the company’s business model from a research focused company to a fully integrated, profitable commercial business. Mr. Michel also served as Chief Financial Officer and Vice President, Corporate Development of Biodel, Inc. from November 2007 to May 2014, and Chief Financial Officer and Vice President of Corporate Development of NPS Pharmaceuticals Inc. from August 2002 to November 2007. Prior to that, Mr. Michel was a Principal at Booz Allen and held a variety of commercial roles at both Lederle Labs and Wyeth Labs. Mr. Michel holds an M.S. in Microbiology from the University of Rochester School of Medicine, an M.B.A. from the Simon School of Business, and a B.S. in both Biology and Geology from the University of Rochester.

We believe that the Board is greatly enhanced by Mr. Michel’s decades of experience in the pharmaceutical and medical technology industries, his strong leadership skills and his in-depth understanding of the Company and its goals from his experience as our Chief Executive Officer.

Gilad Aharon, Ph.D. was appointed as a director of the Company in May 2020. Dr. Aharon is a co-founder of and has served as a Portfolio Manager at Rosalind Advisors, Inc., since 2006. Dr. Aharon holds a Ph.D. in Biophysics and Molecular Biology from the University of Toronto. Prior to co-founding Rosalind Advisors, Dr. Aharon worked as an equity analyst at Infinium Securities Inc. Dr. Aharon’s financial and investment industry experience, his understanding of our business and our industry and his educational background make him extremely valuable to our Board. Dr. Aharon also provides a valuable stockholder perspective to the Board. Dr. Aharon was elected to our Board pursuant to a Board Appointment Agreement entered into with certain of our stockholders, Rosalind Master Fund L.P. and Rosalind Opportunities Fund I L.P.

PROPOSAL 2: TO APPROVE AN AMENDMENT OF THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 40,000,000 TO 80,000,000 SHARES

We are asking our stockholders to approve an amendment to our Amended and Restated Certificate of Incorporation to increase our authorized number of shares of Common Stock from 40,000,000 shares to 80,000,000 shares (the “Charter Amendment Proposal”). In April 2023, the Board adopted resolutions unanimously approving the proposed amendment to our Amended and Restated Certificate of Incorporation, in substantially the form of Appendix B hereto. At that time, the Board determined the proposed amendment and increase of the Common Stock to be advisable and in the best interestsClass II Directors (Term Expires at 2026 Annual Meeting)

Elizabeth Czerepak was appointed as a director of the Company in February 2020. Ms. Czerepak has more than thirty-five years of financial leadership and our stockholdersstrategy development experience across the pharmaceutical and is accordingly submittingbiotechnology fields. Ms. Czerepak most recently served as the proposed amendmentChief Financial Officer at Sorrento Therapeutics, Inc., a clinical stage biopharmaceutical company focused on developing oncology, non-opioid pain, and increaseCovid therapies, from May 2022 to November 2023. Ms. Czerepak also served as Chief Financial Officer at Scilex Holdings Company, a commercial pharmaceutical company focused on developing and commercializing non-opioid pain therapies, from May 2022 to September 2023. She will continue to serve as consultant to Scilex until September 2024. Prior to that, from September 2020 to May 2022, she served as Chief Financial Officer at BeyondSpring Inc. (NASDAQ:BYSI), a global biopharmaceutical company focused on developing innovative immuno-oncology cancer therapies, and from May 2018 to January 2020, she served as Chief Financial Officer and Chief Business Officer of Genevant Sciences, Inc., a technology focused nucleic acid delivery company. Earlier experience includes CFO roles at other biotechnology companies including Altimmune, Inc. (NASDAQ: ALT), Isarna Therapeutics, and Cancer Genetics (NASDAQ: CGIX), where she led Altimmune’s IPO through reverse merger, and Cancer Genetics’ IPO and subsequent uplisting to NASDAQ. She has extensive experience in biotech venture capital investment as a Managing Director at JP Morgan/Bear Stearns, where she led investments in 13 biotech companies, providing primary support in completing large private financings, and exits

through IPO and acquisition. Ms. Czerepak began her career serving in senior and executive level positions for 18 years at BASF Pharma, Hoffmann-La Roche, and Merck & Co. Her pharma executive level experience includes M&A, licensing, business development and finance. Ms. Czerepak served as a member of the Common Stock for approval by our stockholders.If stockholders approve this proposal, we expectboard of directors of Sorrento Therapeutics, Inc. from October 2021 to file the amendment to our Amended and Restated CertificateNovember 2023. In November of Incorporation with the Secretary of State2023, Sorrento announced it commenced voluntary proceedings under Chapter 11 of the StateUnited States Bankruptcy Code and entered into a court-approved asset sale. Ms. Czerepak also served as a director of DelawareSpectrum Pharmaceuticals, Inc. (NASDAQ: SPPI) from June 2019 to increase the total number of authorized shares of our Common Stock as soon as practicable following stockholder approval. In this regard, upon filing of the amendment to our Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, Article FOURTH of the Amended and Restated Certificate of Incorporation would be amended as follows, with the proposed additions double-underlined and proposed deletions stricken through:

“FOURTH: The total number of all classes of shares of capital stock which the Corporation shall have authority to issue is ninety million (90,000,000), consisting of ten million (10,000,000) shares of Preferred Stock, with a par value of $.01 per share, and eighty million (80,000,000) shares of Common Stock, with a par value of $.01 per share.”

As of the close of business on April 20, 2023, of our 40,000,000 authorized shares of common stock, there were 10,620,462 shares of common stock issued and outstanding. In addition to the 10,620,462 shares of common stock outstanding on April 20, 2023, there were 1,135,721 shares reserved for issuance pursuant to outstanding preferred E and E-1 shares, there were 7,545,455 shares reserved for issuance pursuant to outstanding preferred F-1 shares, there were 16,545,155 shares reserved for issuance pursuant to outstanding warrants, there were 488,031 shares reserved for issuance pursuant to convertible debt and 3,350,877 shares reserved for issuance under our various equity compensation plans. As of April 21, 2023, there were 102,449 shares unreserved for any specific purpose remaining available for issuance. Accordingly, at present, there are not sufficient available unissued and unreserved authorized shares of our common stock to meet the needs of our business described below under “ — Reasons for the Increase in Authorized Shares”.

The proposed amendment to our Amended and Restated Certificate of Incorporation would increase the number of shares of Common Stock that we are authorized to issue from 40,000,000 shares of Common Stock to 80,000,000 shares of Common Stock, representing an increase of 40,000,000 shares of authorized Common Stock, with a corresponding increase in the total authorized capital stock, which includes Common Stock and Preferred Stock, from 50,000,000 shares to 90,000,000 shares.

Reasons for the Increase in Authorized Shares

We have had minimal revenue to date, and have a substantial accumulated deficit, recurring operating losses and negative cash flow. We are not profitable and have incurred losses in each year since commencing operations. For the years ended December 31, 2022 and 2021, we incurred net losses of approximately $36.5 million and $25.6 million, respectively and expect to continue to incur losses in 2023. To date, we have funded operations through a combination of private placements and public offerings of our securities, debt financing including convertible notes. If we continue to incur losses, we may exhaust our capital resources,2020, and as a result may be unabledirector of Scilex Pharmaceuticals, Inc., a private company, from 2019 to complete2020. Earlier, from 2001 to 2010, Ms. Czerepak served as a director for many, mostly private, companies in which she was an investor. She received a B.A.

magna cum laude in Spanish and Mathematics Education from Marshall University and an MBA from Rutgers University. In 2020, Elizabeth earned a Corporate Director Certificate from Harvard Business School. Ms. Czerepak brings to our clinical trials, engageBoard extensive experience in product developmentthe pharmaceutical and the regulatory approval process and commercializationbiotech industries, including as a senior finance executive of CHEMOSAT and HEPZATO or any other versions of these products.publicly traded biopharmaceutical companies.

If we are unable to raise capital or generate sufficient revenue, we may not be able to pay our debts when they become due and may have to seek protection under federal bankruptcy law or enter intoJohn R. Sylvester was appointed as a receivership. As of the date of this Proxy Statement, other than future issuances under the Company’s equity compensation plans (including any additional shares available pursuant to the Plan Proposal) and future issuances of the Company’s securities under the Purchase Agreement (as defined below and described in Proposal 4), including issuance of shares upon exercise of outstanding warrantsdirector of the Company in July 2019. He has served as the Company currently has no plans or arrangements to issue the additional authorized shares of Common Stock that would be available as a resultNon-Executive Chairman of the approvalBoard since February 2023. Mr. Sylvester most recently served as CEO of the Authorized Share Increase Proposal. Our Board believes it is appropriateCurium Pharma’s SPECT and International businesses. Prior to increase our authorized sharesthat he served as Chief Commercial Officer of Common Stock so that we have shares of Common Stock available to provide additional flexibility to promptlyBTG plc, which he joined in 2011 and appropriately use our Common Stock for businesshad roles leading both their Interventional Oncology and financial purposes in the future,Interventional Vascular businesses as well as a period as Chief Development Officer accountable for Strategy, M&A and Market access. This culminated in an exit to have sufficient shares availableBoston Scientific for $4.2 billion. Prior to provide appropriate equity incentivesBTG, John was Managing Director of Biocompatibles plc, building their Interventional Oncology business which led to a successful exit to BTG for our employees£166.0 million. John joined Biocompatibles following a period as the Vice President of Marketing for Baxter Healthcare’s $750.0 million European Medication Delivery business based in Brussels then Zurich accountable for six strategic business units incorporating drugs, devices and other eligible service providers. The additional shares of Common Stock, if approved, may be used for various purposes without further stockholder approval. These purposes may include: raising capital; providing equity incentives to employees, officers, directors, consultants and/or advisers; establishing collaborative or partnering arrangements with other companies; expanding our business through the acquisition of other businesses, products or technologies; and other purposes. In light of our capital needs, we regularly consider fund raising opportunities and may decide, from time to time, to raise capital based on various factors, including market conditions and our plans of operation.

Indrug device combinations. Before this, regard, if the Board determines that raising additional capital through issuing the additional shares of Common Stock is desirable, we want to be able to act quickly if market conditions are favorable. Given the lack of sufficient available unissued and unreserved authorized shares of our common stock, if this Proposal 2 is not approved, we will not be able to raise future capital without first obtaining stockholder approval for an increase in the number of authorized shares of Common Stock. The cost, prior notice requirements and delay involved in obtaining stockholder approval at the time that corporate action may be necessary or desirable could completely eliminate our ability to opportunistically capitalize on favorable market windows, which could delay or preclude our ability to advance our development and potential commercialization efforts. In addition, our success depends in part on our continued ability to attract, retain and motivate highly qualified management and clinical personnel, and if the Authorized Share Increase Proposal is not approved by our stockholders, the lack of unissued and unreserved authorized shares of Common Stock to provide future equity incentive opportunities that the Compensation and Stock Option Committee of the Board (the “Compensation Committee”) deems appropriate could adversely impact our ability to achieve these goals. In summary, if our stockholders do not approve this Proposal 2, we may not be able to access the capital markets; continue to conduct the research and development and clinical and regulatory activities necessary to bring any other product candidates to market; complete future corporate collaborations and partnerships; attract, retain and motivate employees, officers, directors, consultants and/or advisers; and pursue other business opportunities integral to our growth and success, all of which could severely harm our business and our prospects.

The Board believes that the proposed increase in authorized common stock will make sufficient shares available for the conversion of the Series F Preferred Stock (as defined below and described in Proposal 4) and to provide the additional flexibility necessary to pursue our strategic objectives. Over the past several years, our authorized Common Stock has allowed us the flexibility to pursueJohn held a number of financing transactions that were key to enabling our support of our HEPZATO development program while at the same time enabling us to continue to provide the employee equity incentives that we deem necessary to attract and retain key employees. Unless our stockholders approve this Proposal 2, we will not have any unissued and unreserved authorized shares of Common Stock to support the growth needed for HEPZATO and any development of other product candidates by engaging in similar transactionssenior commercial roles in the futureindustrial sector. Immediately prior to Baxter Healthcare, John was the General Manager of a Minerals company with $4.0 billion of assets on three continents, $500.0 million of sales and to respond to compensatory needs by implementing new or revised equity compensation plans or arrangements, all1,500 employees. John graduated with joint honors in Biochemistry and Applied Molecular Biology from the University of which could severely harm ourManchester Institute of Science and Technology (U.M.I.S.T.).

Mr. Sylvester’s extensive international experience with business strategy and our prospects.

Effects of the Increase in Authorized Shares

The additional Common Stock to be authorized by adoption of the amendment would have rights identical to the current outstanding Common Stock of the Company. Adoption of the proposed amendment and issuance of the Common Stock would not affect the rights of the holders of currently outstanding Common Stock, except for effects incidental to increasing the number of shares of the Common Stock outstanding, such as dilution of the earnings per share and voting rights of current holders of Common Stock. The additional shares of Common Stock authorized by the approval of this proposal could be issued by the Board without further vote of our stockholders except as may be required in particular cases by our Amended and Restated Certificate of Incorporation, applicable law, regulatory agencies or Nasdaq listing rules. Under our Amended and Restated Certificate of Incorporation, stockholders do not have preemptive rights to subscribe to additional securities that may be issued by us, which means that current stockholders do not have a prior right thereunder to purchase any new issue of Common Stock in order to maintain their proportionate ownership interestscommercialization in the Company.

The increase inhealthcare space as well as his educational background enhances our authorized sharesBoard.

PROPOSAL 2.

PROPOSAL 3:2: APPROVAL OF AN AMENDMENT TO THE DELCATH SYSTEMS, INC. 2020 OMNIBUS EQUITY INCENTIVE PLAN

We are asking our stockholders to approve an amendment to the Company’s 2020 Omnibus Equity Incentive Plan, as previously amended in

20212023 (which we refer to as the “2020 Plan”), to increase the number of shares of the Company’s Common Stock available for issuance under the 2020 Plan by

2,650,0002,000,000. We are proposing the increase in the number of shares available under the 2020 Plan to enable us to continue offering effective equity compensation to our employees,

non-employee directors and consultants and to take advantage of the significant motivation and retention benefits provided by equity compensation. Our Board unanimously approved the proposed amendment of the 2020 Plan (which we refer to as the “Plan Amendment”) on

April 17, 2023,March 27, 2024, subject to stockholder approval at the Annual Meeting. If approved by the stockholders, the Plan Amendment will become effective as of the date of the Annual Meeting.

On February 14, 2023,

In January 2024, the Company

filed a New Drug Application resubmission tocommercially launched the

U.S. Food and Drug Administration (“FDA”) for the Company’s lead product candidate, HEPZATO KIT (melphalan hydrochloride for injection/hepatic delivery system)

seeking approval of the HEPZATO KIT infor the treatment of patients with unresectable hepatic-dominant metastatic

ocularuveal melanoma, or

mOM, a type of primary liver cancer. The Company needs to hire additional employees to supplement our current 52 employees in order to prepare for U.S. commercialization of HEPZATO KIT, to expand our clinical development activities to include a broader set of solid tumors, to build out our manufacturing and sales capabilities and for other operations.mUM. We do not view the

129,167232,566 shares remaining currently available for grant under the 2020 Plan as sufficient to allow us to execute on our near-term plans, and the proposed increase in the share reserve under the 2020 Plan is expected to provide sufficient shares available for approximately the next year as we scale the business. We are not able to provide a public forecast as to the level of total shares outstanding and utilization of equity awards as a result of the unpredictability of the underlying assumptions and estimates. In particular, our actual usage of stock plan shares for employee awards under the 2020 Plan will be impacted by changes in the number and level of our employees, the type of equity awards we grant, our potential growth and activities, the financial impact of grants and financing activities, as well as other factors, such as industry performance and general business, economic, regulatory, market and financial conditions. These general factors and ones specific to our business are difficult to predict, many are beyond our control and some or all could combine to change the expected life of the stock plan request.

If approved by our stockholders, the Plan Amendment will increase by

2,650,0002,000,000 shares of Common Stock the current authorization of

2,475,0005,125,000 shares of Common Stock for equity compensation awards, for a total share reserve under the 2020 Plan as proposed to be amended of

5,475,0007,125,000 shares of Common Stock.

In determining the amount of the increase contemplated by the Plan Amendment, the Board has taken into consideration the analysis conducted by our compensation consultant

F. W.FW Cook, which looked to manage annual share spend, total overhang levels and competitive market grant practices in an appropriate manner. The analysis considered that we have a large number of outstanding

in-the-money warrants and convertible preferred shares, which results in a capital structure that has approximately

22,098,22630,050,124 shares of common stock and common stock equivalents outstanding.

The proposed reservation of an additional

2,650,0002,000,000 shares under the 2020 Plan is most appropriately considered as

twelveless than seven percent

(12%(7.0%) of the totality of common share equivalents with the

in-the-money warrants and convertible preferred shares included.